Borrowing in High-Interest Economies: Survival Tips

Borrowing money is often necessary for individuals, familiesand businesses. But in high-interest economies, the cost of taking on debt can feel overwhelming. Rising interest rates make loans more expensive, limit access to creditand put pressure on household budgets.

For many, survival depends not only on accessing funds but also on managing repayments wisely. This article explores practical strategies for navigating borrowing in high-interest environments, ensuring financial stability while minimizing risks.

Understanding High-Interest Economies

A high-interest economy is one where the cost of borrowing money is significantly elevated compared to normal conditions. This happens when central banks raise interest rates to control inflation, stabilize currency valuesor prevent excessive lending.

Key Characteristics of High-Interest Economies:

- Higher borrowing costs → Loans, mortgagesand credit card balances become more expensive.

- Slower business growth → Companies avoid expansion due to financing challenges.

- Strained household budgets → Families find it harder to pay off debts.

- Credit accessibility issues → Lenders tighten approval criteria.

In simple terms, high-interest economies make money “more expensive,” forcing both individuals and businesses to adapt strategically.

Why Borrowing Becomes Risky in High-Interest Economies

When interest rates climb, borrowers face a financial squeeze. For example, a loan that once had a manageable 8% interest rate may now carry 18–20%. This impacts both short-term cash flow and long-term financial health.

Main Risks:

- Debt snowballing → Interest accumulates quickly, making repayment harder.

- Reduced affordability → Income must stretch further to cover interest costs.

- Business challenges → Companies delay projects or cut jobs due to high loan expenses.

- Weaker purchasing power → Inflation and high debt together reduce consumer spending.

Survival Tips for Borrowing in High-Interest Economies

1. Re-Evaluate Your Debt Needs

Ask yourself: Do I really need this loan now? Sometimes, delaying a purchase or finding alternatives can save you thousands. Consider alternatives such as savings, joint investmentsor lower-cost credit sources before borrowing.

2. Shop Around for Better Loan Terms

Not all lenders respond to high-interest markets in the same way. Credit unions, online lendersor government-backed programs may still offer competitive rates. Comparing options could cut your repayment burden by a large margin.

3. Opt for Shorter Loan Tenures

While longer repayment terms lower monthly installments, they often lead to higher overall interest payments. In high-interest economies, shorter loan durations can reduce total costs even if monthly payments feel tighter.

4. Consolidate Debts Strategically

Debt consolidation means merging multiple loans into one. By negotiating a fixed interest rate or finding a more affordable lender, borrowers can reduce monthly obligations. However, this strategy only works if you avoid accumulating new debt afterward.

5. Prioritize High-Interest Debt First

Not all debt carries the same weight. Paying off the highest-interest balances first (such as credit cards) helps reduce long-term financial pressure. This “avalanche method” can save significant money compared to paying debts randomly.

6. Build Emergency Savings

It might seem impossible to save when paying high interestbut even a small emergency fund helps. Savings prevent reliance on expensive credit for unexpected expenses like medical bills or repairs.

7. Explore Alternative Financing Options

- Peer-to-peer lending → Often cheaper than traditional bank loans.

- Microfinance institutions → Tailored for small borrowers.

- Family or community loans → Flexible repayment terms.

Each option has pros and consbut exploring them reduces dependence on high-interest banks.

8. Strengthen Your Credit Score

A higher credit score often leads to lower interest rates. Pay bills on time, reduce outstanding balancesand avoid unnecessary credit inquiries. Even small improvements can secure better loan terms.

9. Negotiate with Lenders

Many people underestimate how flexible lenders can be. In tough economies, banks may agree to restructure loans, lower interest ratesor extend repayment terms if you show genuine financial strain.

10. Focus on Increasing Income

When cutting expenses is not enough, increasing income becomes essential. Side hustles, freelancingor investing in skill development can create new revenue streams that cushion high-interest payments.

Comparison: Borrowing in Low vs. High-Interest Economies

| Aspect | Low-Interest Economies | High-Interest Economies |

| Loan Affordability | Easier, cheaper borrowing | Expensive, limited access |

| Business Growth | Encouraged, expansion-friendly | Discouraged, risk-averse |

| Household Budgets | Flexible, manageable debt | Strained, tighter budgets |

| Debt Accumulation | Slower, less costly | Faster, risk of debt traps |

| Investment Attractiveness | Strong, low borrowing costs | Weaker, fewer opportunities |

Step-by-Step Guide to Borrowing Safely in High-Interest Economies

- Assess necessity → Confirm if borrowing is unavoidable.

- Research lenders → Compare multiple sources, not just your primary bank.

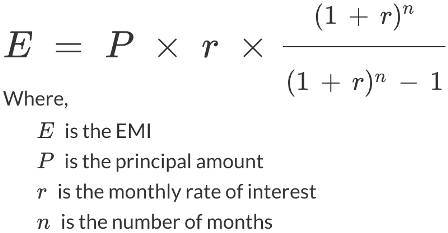

- Calculate affordability → Use a reliable loan calculator to estimate monthly costs (try our free tool to make smarter financial decisions).

- Choose wisely → Select shorter terms and manageable repayment schedules.

- Track repayments → Monitor deadlines and avoid late penalties.

- Review regularly → Reassess debt every 3–6 months to adjust strategy.

FAQs About Borrowing in High-Interest Economies

1. What does a high-interest economy mean?

It refers to a situation where borrowing costs are significantly higher than average, making loans, mortgagesand credit more expensive.

2. Why do governments raise interest rates?

Usually, to control inflation, stabilize currencyand encourage saving instead of overspending.

3. Is it ever smart to borrow in high-interest economies?

Yesbut only if the loan creates value, like funding a business expansion with higher returns than the loan’s interest cost.

4. Should I refinance old loans during high-interest periods?

Refinancing is best during low-interest timesbut if your current rate is exceptionally high, refinancing with a slightly lower one can still help.

5. How do high-interest economies affect small businesses?

They limit expansion, raise costs of capitaland often reduce consumer demand, making survival harder for small enterprises.

6. Can credit cards become dangerous in high-interest markets?

Yes. Credit card debt grows rapidly because of compounding interest, making it one of the riskiest debts.

7. What’s better: paying off debt or saving during high-interest times?

Prioritize paying off high-interest debt first while maintaining a small emergency fund for unexpected costs.

8. Do interest rates impact mortgages heavily?

Absolutely. Even a 2–3% rise in rates can add thousands to the total cost of a mortgage.

9. Are alternative lending platforms safe?

They can bebut it’s important to research credibility, termsand security before committing.

10. How can I stay disciplined while repaying debt?

Create a repayment plan, automate paymentsand track progress monthly to avoid slipping back into debt cycles.

Conclusion

Borrowing in high-interest economies is challenging but not impossible. With careful planning, debt prioritizationand smart negotiation, you can manage loans without falling into financial traps. Always explore alternatives, strengthen your creditand use tools like loan calculators to understand the real cost of borrowing before making commitments.

- how inflation impacts borrowing interest rates

- how debt to income ratio shapes loan eligibility

- how currency exchange rates affect international loans

- how credit scores affect borrowing power

- housing finance systems usa vs uk vs asia

- home loans liberty everything you need to know before applying

- home loans for teachers a complete guide to affordable financing

- home loans for educators a complete guide

- home loan calculator how to plan your mortgage payments

- green loans financing for eco friendly projects

- future of borrowing digital lending ai in finance

- fastest home loan approval how to get approved quickly without stress 2

- fastest home loan approval how to get approved quickly without stress

- farm loan calculator australia everything you need to know

- explore the best loan options worldwide

- estimate your student loan interest before applying uk 2025 guide