How Inflation Impacts Borrowing & Interest Rates

Inflation is a term most of us hear regularlybut its ripple effects on personal finance are often misunderstood. At its core, inflation refers to the rising cost of goods and services over timewhich slowly erodes the purchasing power of money.

While this sounds simple, its influence on borrowing decisions and interest rates is far-reaching. Understanding how inflation impacts lending, creditand overall financial health can help both individuals and businesses make smarter choices when it comes to debt management and investments.

What Is Inflation?

Inflation is the sustained increase in the general price level of goods and services within an economy. When inflation rises, each unit of currency buys fewer goods and services compared to before. Economists typically measure it using indexes like the Consumer Price Index (CPI) or the Producer Price Index (PPI).

Key Points to Remember:

- Mild Inflation (2–3%) is often seen as a sign of healthy economic growth.

- High Inflation reduces purchasing power and can destabilize financial planning.

- Deflation (negative inflation) may seem attractive but usually signals economic weakness.

The Link Between Inflation and Interest Rates

The relationship between inflation and interest rates is like a balancing act. Central banks such as the U.S. Federal Reserve, adjust interest rates to control inflation.

- When inflation rises, central banks usually increase interest rates to cool spending and borrowing.

- When inflation falls, they lower interest rates to encourage economic activity.

This constant adjustment aims to keep inflation within a target rangeoften around 2%.

How Inflation Impacts Borrowing

Borrowing is directly influenced by inflation because of how it affects both lenders and borrowers.

1. Higher Borrowing Costs

When inflation climbs, lenders demand higher interest rates to protect themselves from the declining value of money. This means mortgages, auto loansand business credit lines all become more expensive.

Example: If you borrowed $100,000 at a 3% rate last year, you may now be offered the same loan at 6% or higher during high-inflation periods.

2. Reduced Loan Accessibility

Banks and lenders tighten credit requirements during inflationary spikes. Borrowers with lower credit scores may find it harder to secure loans.

3. Impact on Fixed vs. Variable Loans

- Fixed-rate loans protect borrowers since their repayment amount doesn’t change.

- Variable-rate loans expose borrowers to sudden increases in interest costs as inflation forces lenders to adjust rates.

How Inflation Affects Interest Rates

Inflation doesn’t just influence whether people borrow; it changes how much they ultimately pay back.

Short-Term Effects

In the short run, rising inflation often leads to quick hikes in interest rates. Credit cards and adjustable-rate loans are the first to feel the squeeze.

Long-Term Effects

Over time, inflation reshapes lending markets. Investors demand higher yields on bonds, banks restructure lending modelsand governments adjust monetary policies.

Borrowers vs. Lenders: Who Wins and Who Loses?

| Impact of Inflation | Borrowers | Lenders |

| Rising Prices | Lose purchasing power | Face reduced loan value |

| Fixed-Rate Loans | Benefit (repay with “cheaper” money) | Lose (receive less valuable payments) |

| Variable-Rate Loans | Lose (payments rise) | Benefit (higher interest income) |

| Savings & Deposits | Lose (money buys less) | May adjust rates upward |

This comparison shows why understanding inflation is critical before taking on debt.

The Role of Central Banks

Central banks act as the financial “referee.” Their primary tools to manage inflation include:

- Raising or lowering benchmark interest rates.

- Quantitative easing or tightening (adjusting money supply).

- Communicating expectations to stabilize markets.

When inflation runs high, raising interest rates discourages borrowing and spending. When inflation is low, lowering rates stimulates economic growth.

Real-Life Example: Mortgage Borrowing During Inflation

Imagine you are buying a house worth $200,000.

- In a low-inflation environment, you secure a 30-year mortgage at 3%. Monthly payments are affordableand your money retains steady value.

- In a high-inflation environment, the same loan could be offered at 7%. Payments skyrocket, making the dream of homeownership harder to achieve.

This example highlights why timing matters when borrowing.

Strategies for Borrowers During Inflation

If you are planning to borrow money during inflationary times, here are some practical tips:

- Lock in Fixed Rates – Secure loans with fixed interest rates to avoid sudden hikes.

- Refinance Early – Refinance existing debt before inflation pushes rates higher.

- Borrow Strategically – Only borrow for essential or value-appreciating assets (like real estate).

- Improve Credit Score – A higher score may give access to lower rates even during inflation.

- Diversify Income Sources – Rising costs can strain budgets, so additional income streams help.

The Dual Effect on Businesses

Businesses also face a double-edged sword:

- Borrowing Becomes Costlier → Companies delay expansions or cut back on hiring.

- Revenue Pressures → Customers spend less due to reduced purchasing power.

However, businesses that manage debt wisely and pass on price increases strategically can still thrive.

Why Inflation Impacts Are Hard to Predict

While the general relationship between inflation, borrowingand interest rates is clear, predicting exact outcomes is complex. Factors include:

- Global economic conditions

- Supply chain disruptions

- Fiscal policy changes

- Consumer confidence

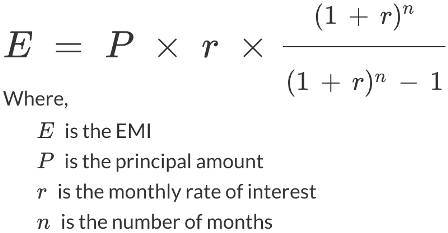

Use a Financial Calculator for Smarter Decisions

To understand how inflation might affect your loans, repaymentsand interest charges, try using our loan and interest rate calculator tool. It helps you see potential scenarios and make better borrowing choices.

FAQs About How Inflation Impacts Borrowing & Interest Rates

1. What happens to borrowing costs when inflation rises?

Borrowing costs typically increase as lenders raise interest rates to offset the declining value of money.

2. Do fixed-rate loans protect against inflation?

Yes, fixed-rate loans shield borrowers from rising ratesbut the money repaid may still hold less value.

3. How do variable-rate loans react to inflation?

Variable-rate loans adjust with market conditionswhich meaning that monthly payments can increase rapidly in high-inflation environments.

4. Why do central banks raise rates during inflation?

They raise rates to reduce spending, slow borrowingand stabilize the economy by cooling demand.

5. Is inflation always bad for borrowers?

Not necessarily. Borrowers with fixed-rate debt can benefit by repaying loans with money that is worth less in the future.

6. How does inflation affect savings accounts?

High inflation erodes the real value of savings unless interest earned outpaces inflation rates.

7. Can businesses benefit from inflation?

Some businesses benefit if they can raise prices without losing customers, though borrowing still becomes costlier.

8. How do government bonds react to inflation?

Bond yields often rise during inflation, as investors demand higher returns to compensate for reduced purchasing power.

9. Does inflation impact personal credit cards?

Yes, most credit cards have variable interest rates, so balances become more expensive to carry during inflationary periods.

10. How can individuals prepare for inflation-related borrowing challenges?

By locking in fixed-rate loans, refinancing early, improving credit scoresand using financial planning tools to forecast repayment scenarios.

Conclusion

Inflation is more than just rising prices at the grocery store it has a profound effect on borrowing, lendingand the cost of credit. By understanding how inflation impacts borrowing and interest rates, individuals and businesses can make informed financial decisions. Whether it’s locking in a fixed-rate loan, monitoring central bank policiesor using tools to simulate repayment scenarios, proactive planning is key.