How to Calculate Your Loan Repayment Without a Calculator

Most people today use online loan calculators to find their EMI (Equated Monthly Instalment). But what if you don’t have internet access or want to double-check the result manually?

Knowing how to calculate loan repayments yourself can help you verify numbers, spot mistakesand understand the math behind your loan.

This guide will walk you through step-by-step manual EMI calculation with examples.

How to Calculate Your Loan Repayment Without a Calculator

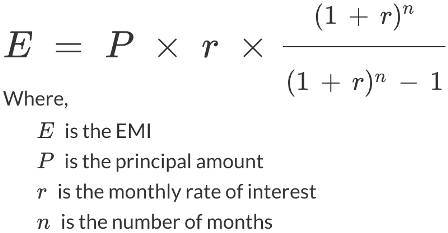

1. The EMI Formula

The standard EMI formula is: EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N−1P×R×(1+R)N

Where:

- P = Principal loan amount (total borrowed)

- R = Monthly interest rate = (Annual Interest Rate ÷ 12 ÷ 100)

- N = Total number of months in the loan term

2. Step-by-Step Example

Loan Details:

- Principal (P) = $100,000

- Annual Interest Rate = 10%

- Tenure = 5 years (60 months)

Step 1: Convert Interest Rate to Monthly

Annual rate = 10%

Monthly rate (R) = 10 ÷ 12 ÷ 100 = 0.008333

Step 2: Calculate (1+R)^N

(1 + 0.008333) = 1.008333

Raise to the power of 60 months:

1.008333^60 ≈ 1.647

Step 3: Apply the Formula

EMI = [100,000 × 0.008333 × 1.647] ÷ [1.647 – 1]EMI = [1,372.5] ÷ [0.647]EMI ≈ $2,120.74 per month

3. Breaking Down the EMI

Your monthly payment ($2,120.74) includes:

- Interest portion (starts high, decreases over time)

- Principal portion (starts low, increases over time)

By the end of the loan, the total amount paid will be:

EMI × months = $2,120.74 × 60 ≈ $127,244.40

Total Interest = $27,244.40

4. Why Manual Calculation Matters

- Double-check calculators — mistakes happen if data is entered wrong

- Better negotiation — you understand exactly how numbers work

- Offline use — useful if you don’t have internet access

- Budgeting clarity — you can estimate repayments in different scenarios

5. Shortcut Method for Quick Estimates

If you just need a rough estimate, use this rule:

For every 1% interest per month, you will pay roughly $10 per $1,000 borrowed for a 12-month term.

Example:

Borrow $10,000 at 1% per month → Approx. $100/month (interest only).

Add principal portion based on tenure for a rough EMI idea.

6. Common Mistakes to Avoid

- Forgetting to convert annual rate to monthly

- Using months instead of years in formula (or vice versa)

- Rounding numbers too early (wait until the final step)

- Ignoring extra charges like processing fees

7. Final Thoughts

While online calculators are convenient, understanding the formula puts you in control. It’s like knowing the recipe instead of just eating the cake — you can tweak, checkand adjust it to suit your needs.

- what is an emi loan how it works

- what is a line of credit

- upload your loan scenario user generated faqs

- understanding emi on car loans in india how to calculate monthly payments in 2025

- top 5 mistakes people make when using a loan calculator

- top 10 mortgage aggregators australia a complete guide for brokers

- tn bank business line of credit guidelines 2025