Loan Myths vs. Facts: What Borrowers Should Know

When it comes to borrowing money, misinformation spreads faster than accurate financial advice. Many people base their decisions on half-truths or outdated assumptionswhich can cost them time, moneyand peace of mind. Understanding Loan Myths vs. Facts is essential for anyone considering a mortgage, personal loan, student loanor business financing.

By separating fiction from reality, you can make smarter borrowing decisions and avoid costly mistakes. In this article, we will debunk the most common myths, highlight the truthsand give you practical guidance every borrower should know.

Why Loan Myths Exist in the First Place

Financial products are often complexand lenders use technical terms that confuse everyday borrowers. Add in word-of-mouth stories, social media “advice,” and cultural beliefsand it’s easy to see why myths gain traction. For instance, many assume they need perfect credit to qualifywhile others believe loan approval is solely about income. In reality, lenders look at multiple factors. By breaking down myths one by one, you will see that borrowing is often more accessible and sometimes more flexible than you think.

Loan Myths vs. Facts: Breaking Down the Misconceptions

Myth 1: You Need Perfect Credit to Get a Loan

Fact: While higher credit scores make approval easier, most lenders also offer options for borrowers with average or even poor credit. For example, FHA loans allow lower credit scoresand some personal loan lenders specialize in subprime borrowers. The catch is that lower credit may mean higher interest rates or stricter terms.

Myth 2: All Loans Are the Same

Fact: Loans differ widely. A mortgage, auto loan, student loanand personal loan each serve unique purposes and come with different requirements, interest ratesand repayment structures. Choosing the right loan depends on your financial goal, not a one-size-fits-all approach.

Myth 3: Applying for a Loan Hurts Your Credit Permanently

Fact: A hard inquiry does lower your credit score temporarily—usually by a few points—but it’s not permanent. The effect fades within a yearand responsible repayment actually builds long-term credit strength.

Myth 4: If You are Self-Employed, You Can’t Qualify

Fact: Self-employed borrowers may face more documentation requirements such as tax returns and business income statementsbut they can absolutely qualify. In fact, many lenders now offer tailored products for freelancers and entrepreneurs.

Myth 5: You Should Always Borrow the Maximum You are Offered

Fact: Just because you qualify for a certain loan amount doesn’t mean you should take it. Borrowing more than you need increases your monthly payments, interest costsand financial stress. A smarter move is to borrow only what aligns with your repayment ability.

Myth 6: A Loan Will Always Put You in Debt Trouble

Fact: Debt becomes a problem only when it’s mismanaged. Strategic borrowing such as taking a student loan for education or a mortgage for a home can actually build wealth in the long run. It’s not the loan that is harmfulbut how you handle it.

Myth 7: Only Banks Offer the Best Loans

Fact: Traditional banks are not the only option. Credit unions, online lendersand peer-to-peer platforms often offer competitive rates, faster approvalsand more flexible terms. Comparing multiple sources ensures you don’t overpay.

Myth 8: Prepayment Always Comes with Penalties

Fact: While some lenders charge prepayment penalties, many modern loan products allow early repayment without extra fees. Carefully review the loan agreement before putting your signature on it.

Myth 9: Co-Signing a Loan Isn’t Risky

Fact: Co-signers are equally responsible for repayment. If the primary borrower defaults, the co-signer’s credit and finances are directly impacted. It’s not just a favor it’s a serious financial commitment.

Myth 10: Online Loans Are Unsafe

Fact: Reputable online lenders are regulated just like traditional banks. While scams exist, doing proper research and checking for accreditation ensures safety. Many borrowers prefer online applications because of convenience and speed.

Comparing Loan Myths vs. Facts: Quick Reference

| Myth | Fact |

| Only perfect credit qualifies | Many lenders accept fair or average credit |

| All loans are alike | Each loan type serves a unique purpose |

| Loan inquiries ruin credit | Impact is small and temporary |

| Self-employed can’t qualify | Extra paperworkbut still eligible |

| Always borrow max amount | Borrow only what you can repay |

| Loans always lead to debt | Responsible borrowing builds financial health |

| Banks are best lenders | Credit unions & online lenders compete strongly |

| Prepayment always penalized | Many loans allow free early repayment |

| Co-signing is safe | Co-signers are equally liable |

| Online loans are unsafe | Reputable lenders are secure |

How to Identify Loan Myths Yourself

Here’s a quick step-by-step approach:

- Check the Source – Is the advice coming from a licensed financial institution or just a friend’s story?

- Read the Fine Print – Loan agreements spell out terms clearly. Don’t assume—verify.

- Compare Lenders – Seeing multiple offers helps you spot misinformation.

- Ask Professionals – Certified financial advisors or loan officers can clarify gray areas.

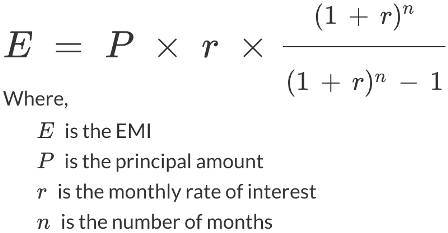

- Use Online Tools – Loan calculators (like the one on our platform) can help you test repayment scenarios before committing.

FAQs on Loan Myths vs. Facts

1. Does checking my credit score lower it?

No. Soft inquiries, like checking your own score, don’t affect credit. Only hard pulls from lenders can temporarily reduce it.

2. Can I get a loan with no credit history?

Yes. Some lenders offer credit-builder loans or require a co-signer. Student loans are another common option for those with limited history.

3. Are fixed-rate loans always better than variable-rate loans?

Not always. Fixed rates provide stabilitywhile variable rates may start lower but can increase over time. The best choice depends on your risk tolerance and market trends.

4. Is debt consolidation always the right move?

It depends. Consolidation can simplify payments and lower ratesbut if you continue overspending, it won’t solve the root issue.

5. Can I negotiate loan terms?

Yes. Many lenders allow negotiation on interest rates, repayment schedulesor fees especially if you have strong credit.

6. Do government-backed loans mean free money?

No. Programs like FHA or SBA loans help reduce risk for lenders but still require repayment with interest.

7. Are payday loans the same as personal loans?

Not at all. Payday loans often carry extremely high interest rateswhile personal loans are more structured and affordable.

8. Will paying off my loan early improve my credit?

It canbut the main benefit is saving on interest. Closing a loan might slightly reduce your credit mixbut the positive outweighs the minor dip.

9. Can I get multiple loans at once?

Yes, if your debt-to-income ratio and credit profile support it. However, stacking loans without planning increases financial risk.

10. Should I avoid loans altogether?

Not necessarily. Loans are tools. When used wisely for education, housingor business growth they can enhance financial security.

The Role of Technology in Busting Loan Myths

Modern borrowers have access to advanced tools that simplify loan research and decision-making. For instance, using our loan calculator tool helps you see repayment schedules, interest costsand affordability in real time. This removes guesswork and gives you clear, fact-based numbers before you borrow.

Conclusion

Misinformation about borrowing often discourages people from pursuing financial opportunities or leads them into avoidable mistakes. By understanding the truth behind Loan Myths vs. Facts, you can approach borrowing with confidence. Remember perfect credit is not required, not all loans are alikeand online lenders can be just as safe as banks.