Student Loan Repayment Plans in the UK Explained (2025 Guide)

Navigating student loan repayment in the United Kingdom can feel overwhelming, especially with the recent changes introduced for the 2025 academic year. With multiple repayment plans, income thresholdsand interest rate variations, it’s crucial to understand how your loan will impact your finances after graduation.

This guide will break down everything you need to know about UK student loan repayment plans—from how they’re structured to how much you will repay and when. Whether you are a recent graduate, current studentor planning your education, this step-by-step guide ensures you are financially prepared.

Types of UK Student Loan Plans (2025)

The UK government categorises student loans under different repayment plans based on when and where you studied.

1. Plan 1

- Applies to: Students who started undergraduate courses in England or Wales before September 2012or in Scotland and Northern Ireland.

- Repayment threshold: £24,990/year (as of 2025).

- Interest rate: Lower of RPI or 1%.

2. Plan 2

- Applies to: English or Welsh students who started university on or after September 2012.

- Repayment threshold: £27,295/year.

- Interest rate: Up to RPI + 3%, based on income.

3. Plan 4 (Scottish Loans)

- Applies to: Scottish students who took loans from April 2021 onwards.

- Repayment threshold: £31,395/year.

- Interest rate: 1.25% (variable annually).

4. Plan 5 (New for 2023–24)

- Applies to: Students in England who started undergraduate courses from August 2023.

- Repayment threshold: £25,000/year (frozen until 2027).

- Interest rate: RPI (no additional %).

5. Postgraduate Loans

- Threshold: £21,000/year.

- Rate: RPI + 3%.

💡 Tip: Unsure of your plan? Use the official Gov.uk tool to find your plan type.

How Repayments Work

Repayment Starts After You Earn Above the Threshold

Repayments are deducted automatically through PAYE (for employees)or via Self Assessment if self-employed. You repay:

- 9% of income above threshold for Plans 1, 2, 4, 5.

- 6% for postgraduate loans.

Repayment Example (Plan 2):

| Annual Income | Amount Above Threshold | 9% Repayment |

|---|---|---|

| £30,000 | £2,705 | £243.45/year |

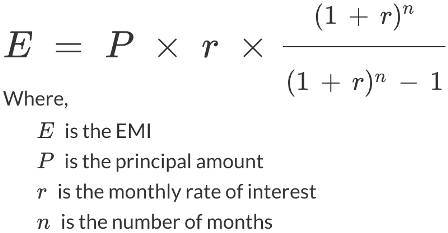

You can also use our Student Loan Calculator to calculate exact EMI based on your plan and salary.

Loan Forgiveness & Cancellation

Each plan comes with a repayment term after which the remaining loan is written off:

| Plan | Loan Write-Off Period |

|---|---|

| 1 | 25 years from first April after graduation |

| 2 | 30 years |

| 4 | 30 years |

| 5 | 40 years |

| Postgraduate | 30 years |

What Affects the Interest You Pay?

Interest rates vary by plan and are influenced by:

- Retail Price Index (RPI)

- Your income (Plan 2 only)

- Policy changes (Plan 5 introduces lower interest over longer term)

Higher earners may repay more interest over timewhile lower earners may never repay the full loan.

Is It Worth Paying Off Early?

Not always.

- If you will never earn above the threshold consistently, extra repayments may not reduce your overall cost.

- Some may benefit from early repayment to avoid compound interest.

Use our full projection tool:

👉 Estimate EMI & Total Repayment

Visual Aid: Plan Comparison Chart

┌─────────────┬────────────┬────────────┬───────────┬──────────────────┐

│ Plan Type │ Threshold │ Rate │ Duration │ Forgiveness Year │

├─────────────┼────────────┼────────────┼───────────┼──────────────────┤

│ Plan 1 │ £24,990 │ ~1% │ 25 yrs │ 2045–2050 │

│ Plan 2 │ £27,295 │ RPI + 3% │ 30 yrs │ 2055–2060 │

│ Plan 4 │ £31,395 │ ~1.25% │ 30 yrs │ 2055–2060 │

│ Plan 5 │ £25,000 │ RPI only │ 40 yrs │ 2065+ │

│ Postgrad │ £21,000 │ RPI + 3% │ 30 yrs │ 2055–2060 │

└─────────────┴────────────┴────────────┴───────────┴──────────────────┘

How to Estimate Your Monthly Repayment

You don’t need to guess. Use this free tool:

It allows you to:

- Enter income and select plan

- Get monthly repayment estimate

- View total repayment until loan is forgiven

Tips for Managing Student Debt in 2025

- Know your plan – Check Gov.uk or Student Finance letter

- Use repayment calculators – To project scenarios

- Avoid over-repayment unless strategic

- Consider career trajectory – Higher salary = faster payoff

- Track interest rates annually – Especially for Plan 2

Frequently Asked Questions (FAQ Schema)

1. What are the repayment plans for UK student loans in 2025?

There are five main plans: Plan 1, 2, 4, 5 and Postgraduate Loan. Each has different thresholds, interest ratesand forgiveness timelines.

2. How is student loan interest calculated in the UK?

It depends on the plan. Plan 2 and postgraduate loans include RPI + a percentage based on income. Plan 5 only uses RPI.

3. When does repayment start?

Repayment starts from the April after you finish your course and earn above the minimum threshold for your plan.

4. Is it worth paying off my UK student loan early?

Only if you are on a high income or want to reduce interest burden. Otherwise, loans are forgiven after a set term.

5. How can I calculate my student loan repayments?

Use our Student Loan Calculator or this projection tool: Estimate EMI & Total Repayment

6. Will Plan 5 loans be more expensive?

Not necessarily. They have lower interest but a longer repayment window (40 years)which may result in higher total repayments for some.

7. Can my student loan affect my mortgage or credit score?

Student loans don’t appear on credit reportsbut repayment amounts can affect affordability assessments for mortgages.

8. What happens if I move abroad?

You must inform the Student Loans Company. Repayments are still due based on foreign income bands.

- how to get the best car loan in india compare 2025 interest rates eligibility

- how to calculate your loan repayment without a calculator

- how to calculate emi manually vs using a calculator

- how much can a mortgage broker make a detailed guide to earnings and career growth

- how inflation impacts borrowing interest rates

- how debt to income ratio shapes loan eligibility

- how currency exchange rates affect international loans

- how credit scores affect borrowing power

- housing finance systems usa vs uk vs asia

- home loans liberty everything you need to know before applying

- home loans for teachers a complete guide to affordable financing

- home loans for educators a complete guide

- home loan calculator how to plan your mortgage payments

- green loans financing for eco friendly projects

- future of borrowing digital lending ai in finance